Why Bitcoin Is Different

For the first time in history, there exists a form of wealth that cannot be printed, seized, or inflated away. Bitcoin’s fixed supply of 21 million coins makes it the only asset capable of compressing centuries of wealth inequality into a single generation—but only if we act before the supply runs out.

THE FOUNDATION:

ABSOLUTE SCARCITY

21 Million.

Not 21 Million and One.

21 Million.

Ever.

Everything you need to know about why Bitcoin can close the wealth gap starts with one number: 21 million.

That’s not a target. It’s not a goal. It’s not subject to change based on demand, economic conditions, or political pressure.

It’s a mathematical law encoded into Bitcoin’s protocol.

What This Means:

No government can print more Bitcoin when they need to fund a war or bail out banks.

No central bank can “ease” the supply to stimulate the economy.

No corporation can issue more shares to dilute your holdings.

No inflation can erode your purchasing power.

21 million Bitcoin. Final. Forever.

They can mine more. Global gold supply increases ~2% every year.

The government can print trillions overnight. The money supply has grown 175% since 2008.

They can build more properties.

Companies can issue more shares, diluting your ownership.

Bitcoin is the first truly scarce digital asset in human history—and the only asset whose scarcity increases over time as coins are lost, forgotten, or held long-term.

The Supply Reality:

Total Bitcoin ever to exist

Bitcoin already mined

Bitcoin actually available to buy

New Bitcoin mined daily

Institutional demand

Demand exceeds supply. Supply keeps shrinking. Prices must rise.

The Supply Shock: Why Black America's Participation Changes Everything

What Happens When Demand Meets Fixed Supply

Now that you understand Bitcoin’s 21 million cap and the current supply reality, here’s where the mathematics become even more powerful for Black America.

When 18 Million Households Enter the Market:

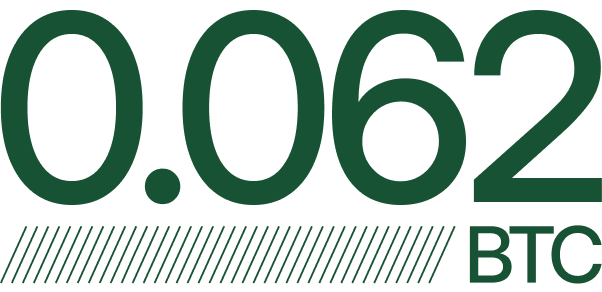

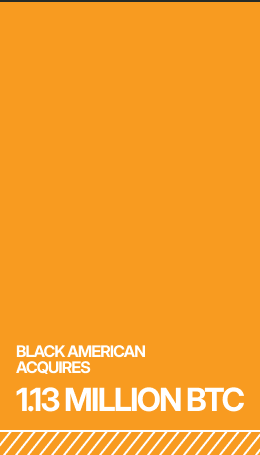

If 18.1 million Black American households each acquire 0.062 BTC (Project Sixty-Two’s goal), that equals 1.13 million Bitcoin—about 5.38% of total supply.

But remember: only 3-4 million Bitcoin are actually available for purchase right now.

That means Project Sixty-Two would absorb 28-38% of all available Bitcoin.

What This Creates:

When demand spikes while supply shrinks, prices adjust upward dramatically.

Research from Bank of America shows that just $93 million in net Bitcoin purchases can move the price by 1%.

Project Sixty-Two represents $95.2 billion—that’s over 1,000 times larger than the amount needed to move Bitcoin 1%.

This is why Bitcoin can close the wealth gap when traditional investments cannot.

Bitcoin’s fixed supply + collective buying: Creates exponential price appreciation that compresses centuries of disadvantage into one generation.

The supply shock drives prices toward $1M, $5M, $10M over 20 years.

This is what asymmetric returns look like: limited downside, exponential upside.

And it’s only possible because of Bitcoin’s fixed 21 million supply meeting unprecedented demand.

But Here’s What Makes This Different From Every Other Investment:

Asymmetric returns are powerful. But for Black America, there’s something even more important about Bitcoin:

It’s the first form of wealth that cannot be taken from us.

Bitcoin Can't Be Taken From Us

Freedom Money:

The First Wealth They Cannot Seize

For centuries, every attempt by Black Americans to build wealth has been met with systematic theft, destruction, or devaluation.

Bitcoin isn’t just another investment opportunity for Black America.

It’s the first form of wealth that cannot be stolen from us.

The History of Theft:

For centuries, every attempt by Black Americans to build and preserve wealth has been met with systematic theft, destruction, or devaluation.

1865-1874: The Freedman's Savings Bank

Established by Congress to help newly freed slaves save money and build wealth. By 1874, over 70,000 Black depositors had accounts.

The bank collapsed due to fraud and mismanagement by its white trustees.

Depositors lost everything—an estimated $3 million (equivalent to ~$75 million today).

The federal government never reimbursed them.

Lesson learned: They can take your bank deposits.

1921: Black Wall Street (Tulsa, Oklahoma)

The Greenwood District was one of the most prosperous Black communities in America. Black-owned businesses, banks, hotels, theaters, and homes—a thriving economic ecosystem built by and for Black people.

On May 31-June 1, 1921, a white mob—supported by local authorities—burned it to the ground.

Over 1,200 homes destroyed. 35 city blocks leveled. An estimated $1.8 million in property destroyed (equivalent to ~$30 million today).

No one was ever prosecuted. No reparations were ever paid.

Lesson learned: They can burn down your property and businesses.

1930s-1960s: Redlining

The federal government literally drew red lines on maps around Black neighborhoods, marking them as “hazardous” for mortgage lending.

Banks refused to give mortgages to Black families—even those who were creditworthy—preventing them from buying homes in appreciating neighborhoods.

Result: White families accumulated wealth through homeownership (the primary wealth-building vehicle in America). Black families were locked out.

The wealth gap from redlining alone is estimated at $212,000 per household in lost home equity.

Lesson learned: They can deny you access to wealth-building assets.

2008: Predatory Lending Crisis

Banks specifically targeted Black communities with subprime mortgages—even when Black borrowers qualified for better loans.

When the housing market crashed, Black families were hit hardest.

Between 2005-2009, Black household wealth dropped 53%—the largest loss of Black wealth in modern American history.

Wells Fargo, Bank of America, and other banks paid fines but never restored the stolen wealth.

Lesson learned: They can target you with predatory schemes and walk away with settlements while you lose everything.

Every Day: Inflation

While the above examples are historical, theft through inflation happens every single day.

Since 2020, the U.S. has printed over $4 trillion in new dollars.

Every dollar printed dilutes the value of every dollar you’ve saved.

Money in savings accounts loses 2-10% of its purchasing power annually—hitting those with the least wealth the hardest.

You work for dollars. They print dollars. Your labor is devalued automatically and permanently.

Lesson learned: They can inflate away your savings without ever touching your bank account.

Why Bitcoin Changes Everything:

Bitcoin cannot be seized without your private keys.

No bank can freeze your account. No government can confiscate it without due process (and even then, only if you give them access). If you control your keys, you control your wealth—completely, permanently, and without anyone’s permission.

Bitcoin cannot be inflated away.

While the dollar loses purchasing power every year through money printing, Bitcoin’s 21 million cap means your holdings can never be diluted. Your percentage of the total supply remains constant forever.

Bitcoin cannot be redlined.

There are no discriminatory lending practices because there are no gatekeepers. The Bitcoin network doesn’t see race, credit scores, zip codes, or income levels. One Bitcoin is one Bitcoin, regardless of who holds it or where they live.

Bitcoin cannot be destroyed.

It exists as decentralized data across tens of thousands of computers worldwide. There’s no building to burn down. No single point of failure. No vault to raid. No mob can destroy what exists everywhere and nowhere simultaneously.

Bitcoin cannot be denied.

You don’t need permission from a bank, broker, or institution. Anyone with $10 and internet access can buy Bitcoin. No one can stop you from owning it, holding it, or transacting with it.

Bitcoin cannot be reversed or stolen through fraud.

Once a Bitcoin transaction is confirmed, it’s permanent. No chargebacks. No “bank error in their favor.” No fine print that lets them take it back.

This Is Why Bitcoin Is Called “Freedom Money”. For the first time, Black America can build wealth outside the control of the institutions that have historically stolen from us.