Project Sixty-Two:

The Path To Wealth Parity

The window is open. But it won’t stay open forever.

Every Black American household acquiring 0.062 Bitcoin is the mathematical key to wealth parity with White America. This is not a dream—it’s a data-driven, achievable plan to eliminate a 400+ year economic divide within the next 20 years.

One Number. One Generation.

One Chance to Close the Gap.

→ Learn More

WHAT IS PROJECT SIXTY-TWO?

The Movement That

Changes Everything

Project Sixty-Two is the Institute for Black Wealth

Empowerment’s transformative initiative to guide every Black American household to acquire at least 0.062447 Bitcoin (we call it 0.062 BTC for short).

There are roughly 18 million Black households in America— each one a potential building block in closing the racial wealth gap. Together, they represent one of the largest coordinated wealth-building efforts in history.

This precise target isn’t arbitrary—it’s the exact amount needed to achieve wealth parity with White America when Bitcoin reaches its projected value of $10 million per coin over the next 20 years.

0.062 BTC represents:

from centuries of wealth extraction to generational prosperity

for economic sovereignty that can’t be inflated, seized, or discriminated against

that turns mathematical disadvantage into mathematical opportunity

At today’s price of $120,000 per Bitcoin, 0.062 BTC costs approximately $7,440 per household—achievable through consistent saving and investment strategies, but worth potentially $620,000 in 20 years.

One number.

One generation.

One chance.

This is the future Project Sixty-Two makes possible. This is the future IBWE works toward—where prosperity is inherited, not imagined.

Where We Are:

The Crisis We Face

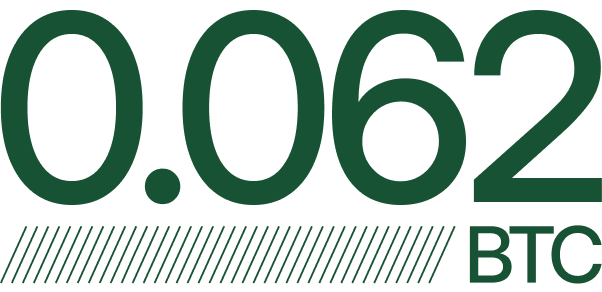

The Mathematical Trap:

Even if both groups grow their wealth at the same rate—let’s say 4% annually—the dollar gap doesn’t shrink. It explodes.

HERE’S WHY:

- 4% growth on $5.4 trillion = $216 billion per year

- 4% growth on $134.6 trillion = $5.38 trillion per year

That means the gap widens by over $5 trillion every single year.

BY 2044 (JUST 20 YEARS FROM NOW):

- White wealth: $295 trillion

- Black wealth: $12 trillion

- The gap grows to $283 trillion—more than twice what it is today

HOUSEHOLD WEALTH:

- White median household: $622,000

- Black median household: $96,000

- The per-household gap grows to $526,000

The Starting Line:

Understanding the 25-to-1 Gap

White Americans

Black Americans

$5.4 TRILLION

THE MEDIAN

WHITE HOUSEHOLD HOLDS

THE MEDIAN

BLACK HOUSEHOLD HOLDS

That’s a 25-to-1 ratio in total wealth.

A 6.5-to-1 ratio at the household level.

The Solution:

How 0.062 BTC Closes The Gap

The Math That Changes Everything

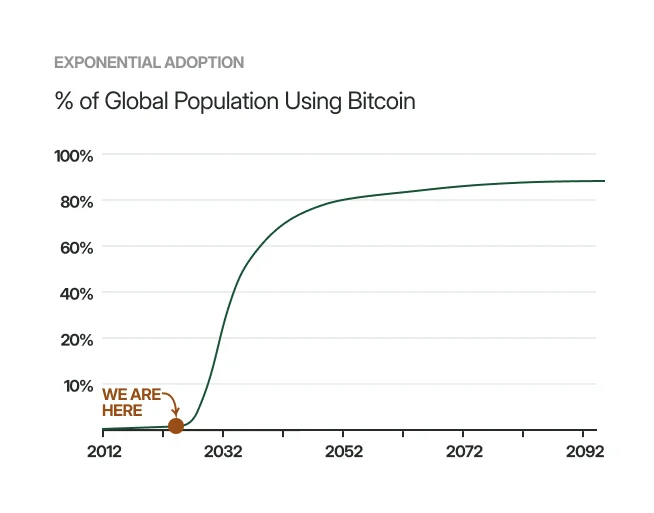

Project Sixty-Two is built on a simple but powerful mathematical reality: Bitcoin’s fixed supply and exponential adoption create asymmetric returns that can compress centuries of inequality into a single generation.

The Target

Every Black American household acquires 0.062447 BTC.

At today’s price of $120,000 per Bitcoin, that’s $7,493 per household.

Achievable through strategic planning and consistent action.

The Outcome

Wealth Parity in 20 Years

When Bitcoin reaches $10 million per coin by 2044—as projected by multiple financial analysts including Michael Saylor, Arthur Hayes, and ARK Invest—that 0.062447 BTC becomes worth:

$624,470 per household

What This Means

Each black household’s 0.062 BTC at $10M=$624,470

This matches the median White household wealth projected for 2044

The per-household wealth gap closed in one generation

Why Now: The Urgency Of Action

The Window Is Open—But Closing Fast

Bitcoin doesn’t wait. Markets don’t pause. And every day of delay makes wealth parity exponentially harder to achieve.

The Price Reality:

2020

2024

2025

2026-2027

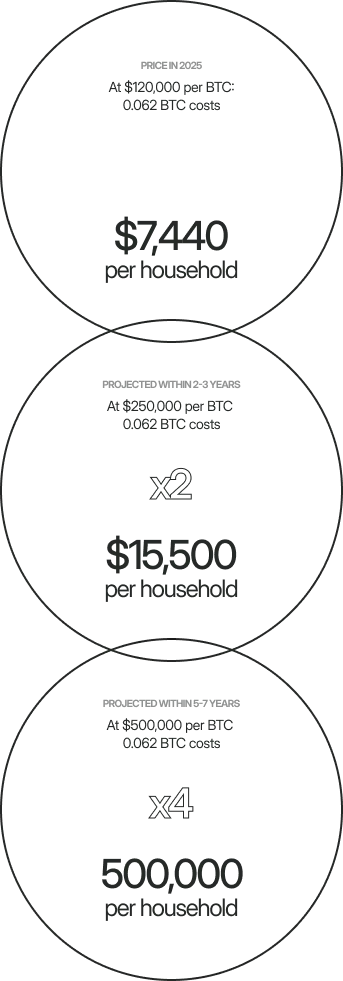

PRICE IN 2025:

At $120,000 per BTC:

0.062 BTC costs

PRICE IN 2025:

At $120,000 per BTC:

0.062 BTC costs

PRICE IN 2025:

At $120,000 per BTC:

0.062 BTC costs

Early participation captures exponential gains. Late participation pays premium prices for linear returns.

THE POWER

OF COLLECTIVE ACTION

When Millions Move Together,

Markets Transform

Project Sixty-Two isn’t just about individual households—it’s about the compounding power of collective participation.

THE MATH OF COLLECTIVE IMPACT:

Right now, approximately 72% of all Bitcoin is held by long-term holders. It’s not for sale.

That means only 3-4 million Bitcoin is available to buy out of the possible 21 million.

If Black America collectively acquires 1.13 million Bitcoins—about 5.38% of total supply—

That represents 28-38% of all available Bitcoin.

WHAT THIS CREATES:

A Supply Shock of Historic Proportion

When Project Sixty-Two succeeds, 1.13 million BTC moves from liquid supply to long-term holding by Black American households. This removes 28-38% of all Bitcoin currently available for purchase from the market.

What happens when demand stays constant but supply drops 28-38%?

Prices rise—dramatically.

Every household that buys Bitcoin under Project Sixty-Two:

Removes supply from the market → Increases scarcity for everyone else

Drives price discovery upward → Makes everyone’s Bitcoin more valuable

Signals legitimacy → Attracts more participants, strengthening the movement

Companies can issue more shares, diluting your ownership.

When you buy and hold, you make everyone else’s Bitcoin more valuable.

When they buy and hold, they make yours more valuable.

This is the opposite of traditional zero-sum wealth—Bitcoin creates cooperative network effects where everyone benefits from collective growth.

THE CULTURAL TRANSFORMATION:

Beyond price impact, Project Sixty-Two creates:

ECONOMIC VISIBILITY:

- Black America demonstrating financial sovereignty

- Shifting narrative from “left behind” to “leading the future”

- Claiming ownership in the digital economy

GENERATIONAL CHANGE:

- Parents teaching children about sound money

- Wealth transfer becoming the norm, not the exception

- Economic literacy spreading through communities

POLITICAL POWER:

- Wealth creates influence—always has, always will

- Economic parity enables proportional representation

- Financial sovereignty translates to policy influence

COMMUNITY RESILIENCE:

- Shared economic success strengthens social bonds

- Collective wealth enables community investment

- Self-determination replaces dependence

Project Sixty-Two isn’t just 18 million individual decisions—

it’s one massive, coordinated movement.

And movements change history.

Addressing The Obstacles

The Challenges We Face—And How We Overcome Them

Project Sixty-Two is achievable, but it’s not without challenges. Let’s address them honestly.

Challenge 1: I Don't Have $7,440

REALITY:

Most Black households don’t have $7,440 in liquid savings. That’s precisely why the wealth gap exists.

SOLUTION:

You don’t need $7,440 today. DCA strategies let you build toward 0.062 BTC over time

Start with $10, $50, or $100 and accumulate consistently

Prioritize Bitcoin allocation the way you’d prioritize rent or debt payments

Consider this: What you spend on things that lose value (new phones, cars, entertainment) could instead become generational wealth

THE MINDSET SHIFT:

We’ve been conditioned to spend on depreciating assets. Bitcoin requires deferred gratification—sacrifice today for prosperity tomorrow.

Challenge 2: Bitcoin Is Too Risky/Volatile

REALITY:

Bitcoin’s price fluctuates significantly. Short-term volatility is real.

COUNTER-REALITY:

Staying in the current system guarantees permanent inequality. That’s the real risk.

SOLUTION:

Think in decades, not days. Every major Bitcoin dip has been followed by new all-time highs

Historical data: Bitcoin has never been lower after any 4-year period. Volatility decreases over time horizons

Prioritize Bitcoin allocation the way you’d prioritize rent or debt payments

Risk vs. certainty: Bitcoin is volatile but offers asymmetric upside. The dollar is “stable” but guarantees inflation and perpetual wealth gaps

REFRAME RISK:

The greatest risk isn’t Bitcoin volatility—it’s accepting permanent economic underclass status for your children.

Challenge 3: I Don't Understand Bitcoin

REALITY:

Bitcoin is technically complex. Most people don’t fully understand it.

COUNTER-REALITY:

You don’t need to understand the code to benefit from the network.

SOLUTION:

You don’t understand how the internet works, but you use it every day

You don’t understand how engines work, but you drive cars

You don’t understand how banks process transactions, but you use credit cards

SOLUTION:

Bitcoin is scarce (21 million max)

Bitcoin can’t be inflated or seized

Bitcoin is open to everyone equally

Bitcoin’s value comes from network adoption

THAT’S ENOUGH:

IBWE provides education, resources, and guidance for the rest.

Challenge 4: What If Bitcoin Fails

REALITY:

Bitcoin could theoretically fail, though increasingly unlikely after 16 years.

COUNTER-REALITY:

What if it succeeds—and you’re not part of it?

SOLUTION:

Assess the asymmetric risk.

IF BITCOIN FAILS:

You lose your investment (which you could afford because you followed the rule: never invest more than you can hold for 20 years)

You’re in the same position as if you’d never tried

The wealth gap remains unchanged

IF BITCOIN SUCCEEDS AND YOU DIDN’T PARTICIPATE:

You watch from the sidelines as wealth concentrations in Bitcoin

The new economy is built without your ownership

Your children inherit struggle while others inherit sovereignty

You missed the only mathematical path to wealth parity in your lifetime

DOWNSIDE RISK:

Partial or total loss of discretionary investment

UPSIDE POTENTIAL:

83× return and generational wealth

Which regret can you live with?

The Call To Action:

Your Role In Project Sixty-Two

History Is Written by Those Who Act

You’ve read the vision. You understand the math. You know the urgency. Now comes the only question that matters: What will you do? The Three Commitments:

Make a personal pledge: I will acquire 0.062 BTC for my household.

Write it down. Say it out loud. Share it with family.

This isn’t a wish—it’s a commitment. Treat it like rent, like debt payments, like survival—because in 20 years, it will determine your family’s economic reality.

Act within the next 3 days.

Not “someday.” Not “when I’m ready.” Not “after I research more.”

Within 3 days:

- Open a Bitcoin account

- Make your first purchase (any amount)

- Set up automatic recurring investments

The first 0.001 BTC is harder than the next 0.061. Starting breaks the inertia. Delaying preserves it.

Time is the only resource you can’t replenish. Use it now.

Share Project Sixty-Two with 5 people this week.

Movements don’t spread through institutions—they spread through individuals.

Who needs to hear this?

- Your parents, siblings, children

- Your closest friends

- Your church or community group

- Your coworkers

- Your social media followers

When 1 person tells 5, and those 5 tell 5 more, Project Sixty-Two reaches millions.

Share Project Sixty-Two

THE FINAL

WORD

The Moment

That Defines a Generation

One number.

One generation.

One chance.

The window is open now—but it won’t stay open forever.

For 400 years, Black Americans built wealth for others. For the next 20, we build it for ourselves.

Project Sixty-Two isn’t a dream—it’s a plan. A data-driven blueprint with the power to compress centuries of inequality into a single generation.

When the future arrives,

the only question will be:

Did you act, or did you wait?

This is your moment.

This is our movement.

This is Project Sixty-Two.

Buy Bitcoin.

Build Wealth.

Close the Gap.

Project Sixty-Two is an initiative of the Institute for Black Wealth Empowerment (IBWE), a think tank dedicated to eliminating the racial wealth gap through strategic Bitcoin acquisition, research, education, and cooperative wealth-building.